Unlock Cash. Plan Business Transition.

Smart Business Solutions for Scaleups

Welcome To Business Balance Sheet

Business Balance Sheet exists to serve the small to medium business segment: $2M to $50M. We support business founders, business owners and the people charged with running the business.

We are here to help you build a business ownership system. Not to run the business, but to own the business. We’ll guide you so that you can choose the way you engage with your business and let you focus on the parts you love.

If you want to learn the financials in a user friendly way or begin the transition of your business to a more you-friendly approach then click below to start the journey.

Latest Articles

New Year. New You?

Welcome to 2022. We often get asked as we start a new year "what are your new year resolutions?" I'm never quite sure how to respond as some people love the idea of renewal based on a New Year whilst others think it is a bunch of Wah. Personally, I'm in the middle on...

Get a Dog

Meet Diego. He's an English staffy and he LOVES to walk. Which means I end up walking a lot as well. He starts nudging me around 6am. Luckily for me I'm an early riser so we get up and go. Any day I'm not walking he sulks. As a result I have found multiple walking...

Getting To Flow

Business is all about momentum. Jim Collins talks about building a flywheel. Momentum builds. Take an Action. Get a Result. Take an Action. Get a Result. Rinse. Repeat. Creating and maintaining momentum is about flow, in the business sense. When things are going...

Our Products

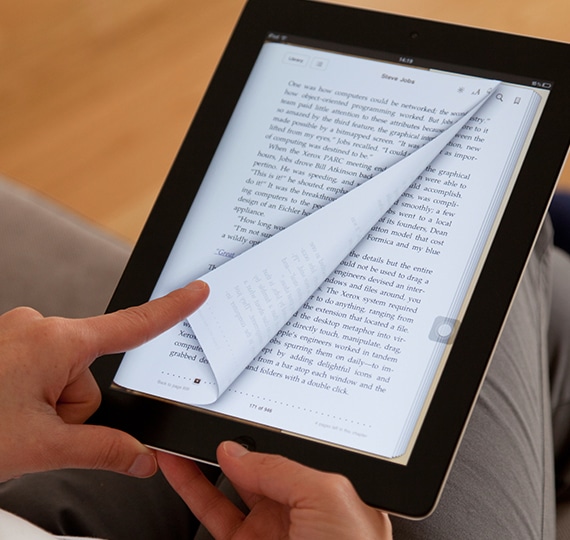

E-Book

The professionals have made the financials seem hard and scary. They don’t have to be. This book will guide you through the basics from a business perspective not the gobbledygook from an accountant perspective. Learn the financials and it will start the journey to the next level

Financial Diagnostic

If you want to really gain an insight in to the state of your business then we recommend undertaking a financial diagnostic.

This involves providing us a copy of your financial statements for the last 3-5 years. To get the most value from this diagnostic, the financial statements should include the following:

1. Income Statement (Profit/Loss Statement) 2. Balance Sheet 3. Cashflow Statement

Founder To Owner

Advisory

Funding Assessment

This is a COMPLIMENTARY analysis of your business performance and provide some quick insight in to the likely sources of funding capital to grow your company.

Consulting